Top 5 AI Stocks to Watch in 2024: A Closer Look at Nextech3D.ai

As we venture further into the technological frontier, artificial intelligence (AI) continues to play a pivotal role in shaping the landscape of various industries. In this blog post, we'll delve into the top 5 AI stocks poised for success in 2024, with a special spotlight on Nextech3D.ai, a publicly traded small cap with the symbol NEXCF.

1. NVIDIA Corporation (NVDA):

• Overview: NVIDIA, a leader in graphics processing units (GPUs), has diversified its portfolio to become a powerhouse in AI. Its GPUs are crucial for AI applications, from data processing to machine learning model training.

• Investment Thesis: The increasing demand for high-performance computing in AI, coupled with NVIDIA's focus on AI hardware and software, positions the company for substantial growth. As AI continues to advance, NVIDIA remains a key player in providing the underlying technology.

2. Alphabet Inc. (GOOGL):

• Overview: Google's parent company, Alphabet, has been at the forefront of AI research and application development. From Google Search algorithms to advancements in natural language processing, Alphabet's AI endeavours are diverse and impactful.

• Investment Thesis: With Google's strong position in cloud computing and AI-driven technologies, Alphabet is well-positioned to benefit from the increasing adoption of AI across various sectors. The company's innovative AI projects contribute to its long-term growth potential.

3. Amazon.com, Inc. (AMZN):

• Overview: Amazon's foray into AI is evident through its AI-driven recommendation algorithms, voice-activated assistant Alexa, and investments in machine learning for logistics and operations.

• Investment Thesis: As a tech giant with a vast ecosystem, Amazon's integration of AI enhances customer experiences and operational efficiency. The company's continued investment in AI technologies positions it as a strong contender in the AI stock landscape.

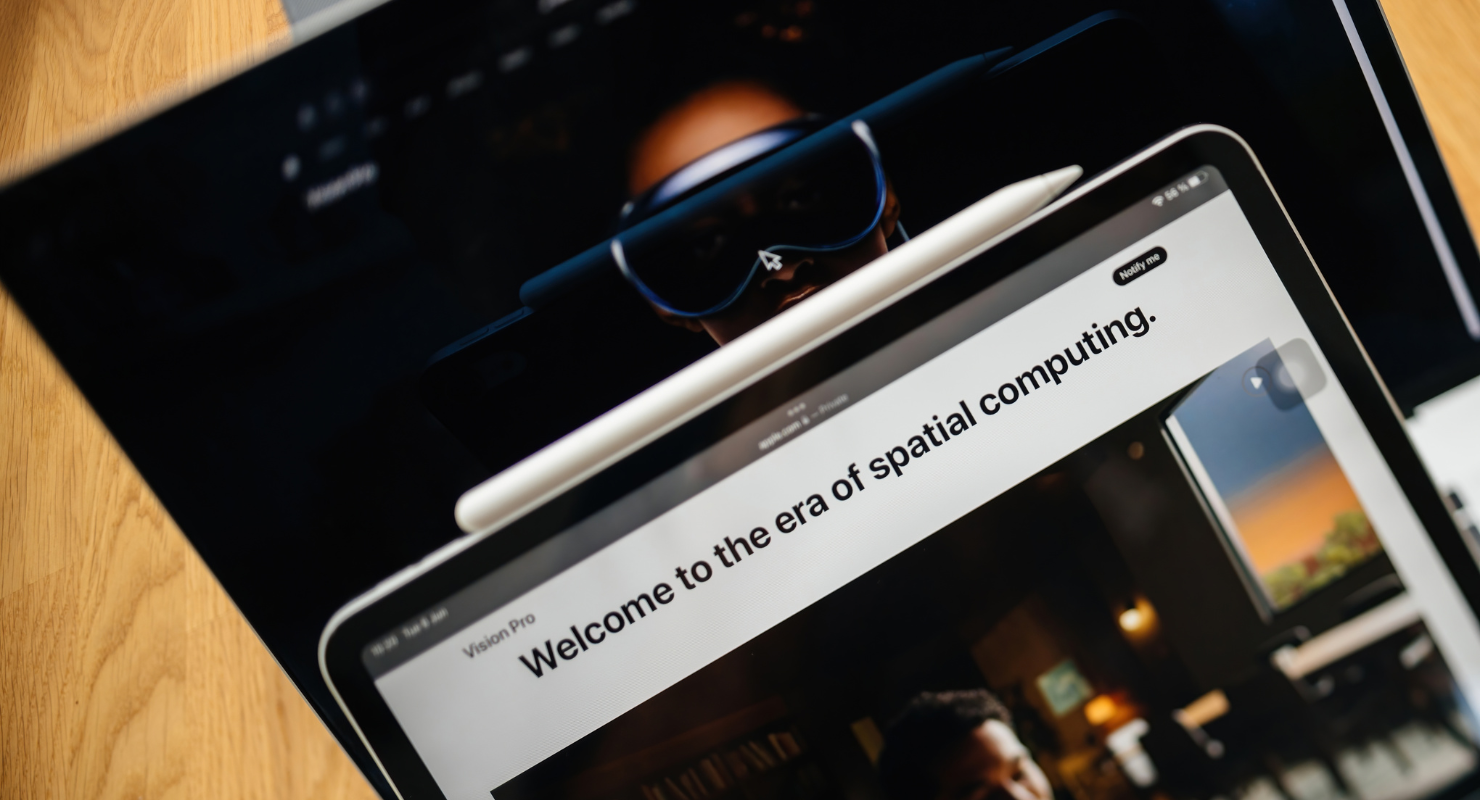

4. Nextech3D.ai (NEXCF):

• Overview: Nextech3D.ai is making waves in the AI space with its focus on spatial computing and augmented reality. The company leverages AI to create immersive AR experiences, unlocking new possibilities for industries such as e-commerce, education, and healthcare.

• Investment Thesis: As a publicly traded small cap with the symbol NEXCF, Nextech3D.ai represents an exciting prospect in the AI landscape. Investors should monitor the company's growth and developments as it pioneers innovative AI applications.

5. Salesforce.com, Inc. (CRM):

• Overview: Salesforce has been integrating AI into its cloud-based CRM solutions, enhancing customer relationship management with predictive analytics and intelligent automation.

• Investment Thesis: The growing importance of data-driven decision-making and personalized customer experiences positions Salesforce as a strong AI stock. As businesses increasingly adopt AI for enhancing customer engagement, Salesforce is well-positioned to capitalize on this trend.

Strategic Considerations for AI Investment Choices

Investing in AI stocks requires a strategic approach, considering the dynamic nature of the tech industry. NVIDIA, Alphabet, Amazon, Salesforce, and Nextech3D.ai (NEXCF) are positioned as leaders in driving innovation and shaping the future of artificial intelligence. Investors should conduct thorough research and stay informed about industry trends to make well-informed decisions in this rapidly advancing field.

About Nextech3D.ai

Nextech3D.ai is at the forefront of providing 3D modeling and AR solutions. Nextech3D.ai is democratizing 3D and AR with ARitize3D and ARway.ai, making them more accessible to businesses worldwide and enabling them to evolve their digital and sales ecosystem to stay ahead of the competition in the dynamic, ever-changing consumer landscape.